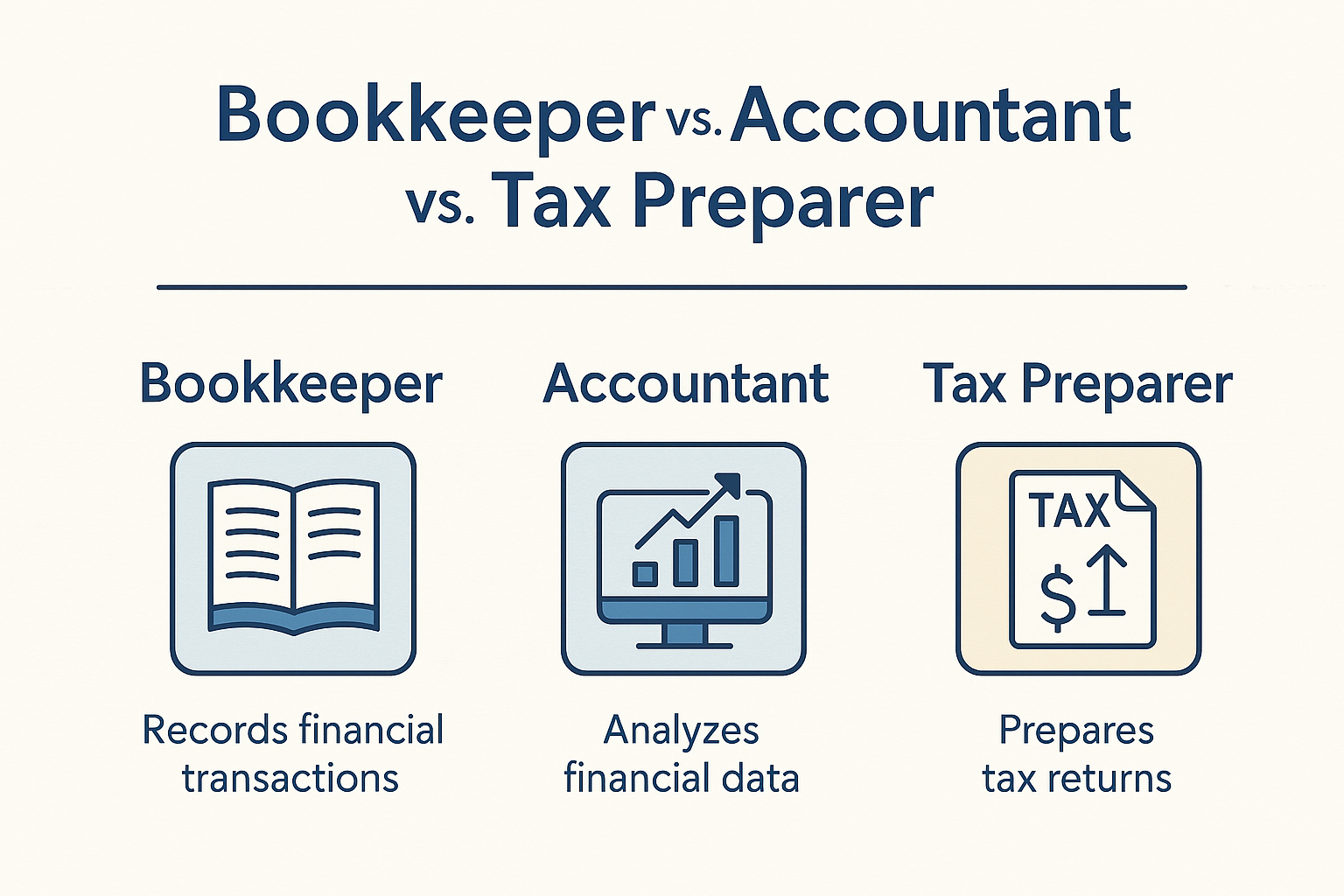

Bookkeeper vs. Accountant vs. Tax Preparer

What’s the Difference—and Who Does Your Business Really Need?

Running a small business means wearing a lot of hats—but “financial expert” doesn’t have to be one of them. That’s where professionals like bookkeepers, accountants, and tax preparers come in. While their roles overlap, each one serves a distinct purpose in keeping your business financially healthy, compliant, and ready to grow.

Understanding the differences helps you choose the right support at the right time. Here’s a clear breakdown.

📘 Bookkeeper: The Foundation of Your Financial System

A bookkeeper is your day‑to‑day financial organizer. They keep your financial world clean, accurate, and up to date so you always know where your business stands.

What a Bookkeeper Does

Records all financial transactions

Categorizes income and expenses

Reconciles bank and credit card accounts

Manages invoices, bills, and receipts

Prepares financial reports like profit & loss statements

Maintains a clean, audit‑ready set of books

May provide insights to changes month-over-month or year-over-year and advanced reporting

Why It Matters

Bookkeeping is the backbone of your financial clarity. Without accurate books, tax prep becomes stressful, financial decisions become guesswork, and growth becomes harder to plan.

*Think of a bookkeeper as the person who keeps your financial house spotless year‑round.

📊 Accountant: The Analyst and Advisor

An accountant builds on the work of the bookkeeper. They interpret the financial data, provide insights, and help you understand the bigger picture.

What an Accountant Does

Reviews and analyzes financial statements

Provides budgeting and forecasting guidance

Helps with financial strategy and planning

Ensures compliance with accounting standards

May prepare tax returns (if licensed or trained)

Why It Matters

Accountants help you make informed decisions—whether you’re planning to hire, expand, or simply understand your profitability. They translate numbers into strategy.

*If bookkeeping is the foundation, accounting is the architecture.

🧾 Tax Preparer: The Compliance Specialist

A tax preparer focuses specifically on tax filings and compliance. They ensure your returns are accurate, timely, and aligned with current tax laws.

What a Tax Preparer Does

Prepares and files federal and state tax returns

Identifies deductions and credits

Helps you stay compliant with IRS requirements

Advises on tax‑related questions and obligations

Who Can Be a Tax Preparer?

CPAs

Enrolled Agents (EAs)

Tax attorneys

Trained tax professionals (e.g., at tax prep firms)

Why it Matters

Tax preparers help you avoid penalties, reduce tax liability, and stay compliant. But they rely heavily on accurate bookkeeping to do their job well.

*Tax prep is seasonal. Clean books are year‑round.

How These Roles Work Together

Here’s the simplest way to think about it:

Bookkeeper: Keeps your financial data accurate and organized

Accountant: Interprets that data and advises on strategy

Tax Preparer: Uses that data to file your taxes correctly

When these three roles work in harmony, your business runs smoother, your stress goes down, and your financial clarity goes up.

Which One Do You Need?

Most small businesses benefit from:

A bookkeeper year‑round

A tax preparer annually

An accountant as needed for strategy, growth, or complex financial questions

If your books are messy, behind, or overwhelming, start with a bookkeeper. Clean books make everything else easier.

Final Thoughts

Understanding the difference between a bookkeeper, an accountant, and a tax preparer empowers you to build the right financial support system for your business. Each plays a unique role—but bookkeeping is the foundation that makes everything else possible.